net investment income tax 2021 form

1 It applies to individuals families estates and trusts but certain income thresholds must be met before the tax takes effect. But in this case youll owe it on the 15000 MAGI overagesince its less than your net investment income.

How Are Dividends Taxed Overview 2021 Tax Rates Examples

The net investment income tax is a 38 tax on investment income that typically applies only to high-income taxpayers.

. April 28 2021 The 38 Net Investment Income Tax. This tax must be reported on Form 990-PF Return of Private Foundation. If an individual has too little withholding or fails to pay enough quarterly estimated taxes to also cover the Net Investment Income Tax the individual may be subject to an estimated tax penalty.

According to the instructions. The adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax year. Net investment income can be capital gains interest or dividends.

The estates or trusts portion of net investment income tax is calculated on Form 8960 Net Investment Income TaxIndividuals Estates and Trusts and is reported on Form 1041 US. When youre ready to report and pay your NIIT youll do so via Form 1040. Include state local and foreign income taxes you paid for the tax year that are attributable to net investment income You can determine the portion of your state local and foreign income taxes allocable to net investment income using any reasonable method.

Net Investment Income Tax. The Net Investment Income Tax in Practice. Tax status NIIT Threshold Married Filing Jointly 250000 Head of Household 200000 Single 200000 Married Filing Separately 125000.

Form 8960 Instructions PDF provides details on how to figure the amount of investment income subject to the tax. Attach Form 8960 to your return if your modified adjusted gross income MAGI is greater than the applicable threshold amount. April 8 2021 756 AM.

If it turns out that your net investment income is zero or less you dont need to file the form with your taxes. Generally net investment income includes gross income from interest dividends annuities and royalties. If your net investment income is 1 or more Form 8960 helps you calculate the NIIT you might owe by multiplying the amount by which your MAGI exceeds the applicable threshold or your net investment incomewhichever is the smaller figureby 38.

4 rows Total section 1411 NOL allowed as deduction against 2021 net investment income 55000 In. Lets say you have 30000 in net investment income but your MAGI only goes over the threshold by 15000. Income Tax Return for Estates and Trusts Schedule G Line 4.

Our guide covers the current rates thresholds and other rules. The net investment income tax NIIT is a surtax on high amounts of investment income. The tax applies to passive investment income.

Overview Data and Policy Options Since 2013 certain higher-income individuals have been subject to a 38 unearned income Medicare contribution tax more commonly referred to as the net investment income tax NIIT. For estates and trusts the 2021 threshold is 13050 Definition of Net Investment Income and Modified Adjusted Gross Income. The Net Investment Income Tax is separate from the Additional.

Individuals who have for the tax year a modified adjusted gross income MAGI that is over an applicable threshold amount and b net investment income must pay 38 of the smaller of a or b as. 20 2019 the excise tax is 139 of net investment income and there is no reduced 1 percent tax rate. On Form 8960 attached to Form 1040 the taxpayer computes the tax.

Again youll owe the 38 tax. The Net Investment Income Tax shouldnt be an everyday or every year thing it applies to investment income above a fairly large threshold. If you discover you owe net investment income tax you must report it on Form 1040.

Future Developments For the latest information about developments related to Form 8960 and its instructions such as legislation. According to an April 28 2021 Congressional Research Service Report the Joint Committee on Taxation estimates that the net investment income tax will raise approximately 275 billion of revenue in 2021 and that the majority of the tax is paid by higher-income households see Congressional Research Service The 38 Net Investment Income Tax. Married filing jointly 250000.

Estates and trusts that owe the tax use Form 1041 for reporting purposes. Make changes to your 2021 tax return online for up to. 2021 Instructions for Form 8960 Net Investment Income TaxIndividuals Estates and Trusts Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted.

If the amount on your 2021 Federal Form 10401040-SR1040NR line 18 is zero and the Net Investment Income Tax from line 17 202 1. Application to Individuals US. For tax years beginning after Dec.

Estates and trusts looking to file the NIIT should use Form 1041. The statutory authority for the tax is. A the undistributed net investment income or B the excess if any of.

Payment of the tax is subject to estimated tax requirements. A simple tax return is Form 1040 only without any additional schedules. Net investment income tax is reported on line 60 of Form 1040.

Youll owe the 38 tax.

Form 8615 Tax For Certain Children With Unearned Income Jackson Hewitt

Tax Time 2021 Stationery Has Been Released Updated Taxbanter

Company Tax Rates 2022 Atotaxrates Info

Lump Sum E Payment Tax Offset 2022 Atotaxrates Info

Sources Of Personal Income In The United States Tax Foundation

5 Steps For Reporting Crypto On Your Tax Forms Tokentax

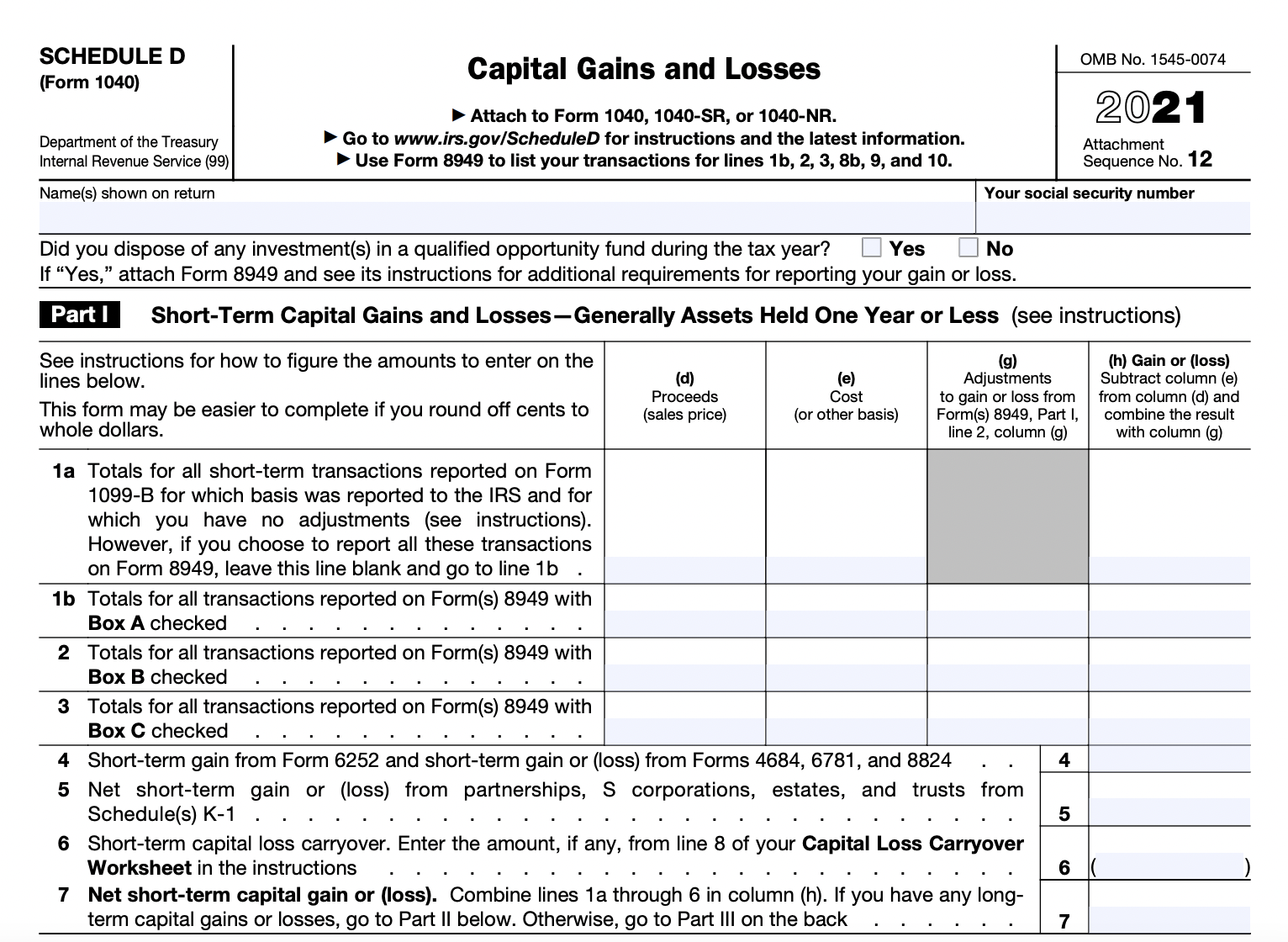

:max_bytes(150000):strip_icc()/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

Irs Form 1040 Individual Income Tax Return 2022 Nerdwallet

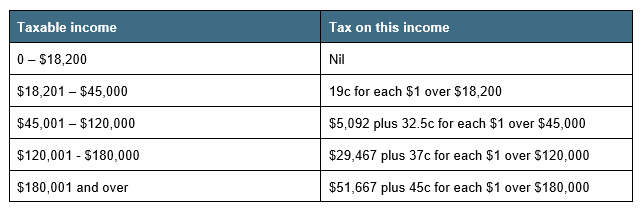

Australian Income Tax Brackets And Rates 2021 22 And 2022 23

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

Company Tax Rates 2022 Atotaxrates Info

What Is The The Net Investment Income Tax Niit Forbes Advisor

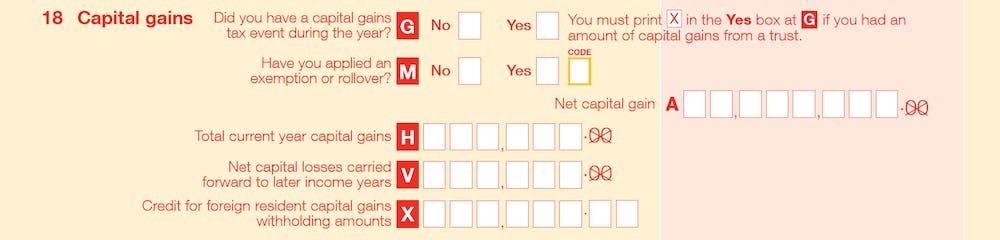

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

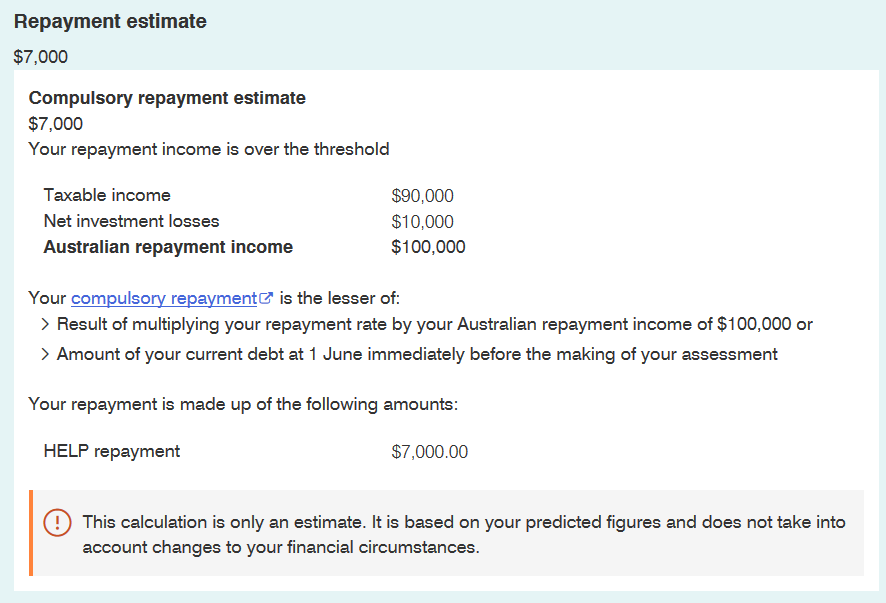

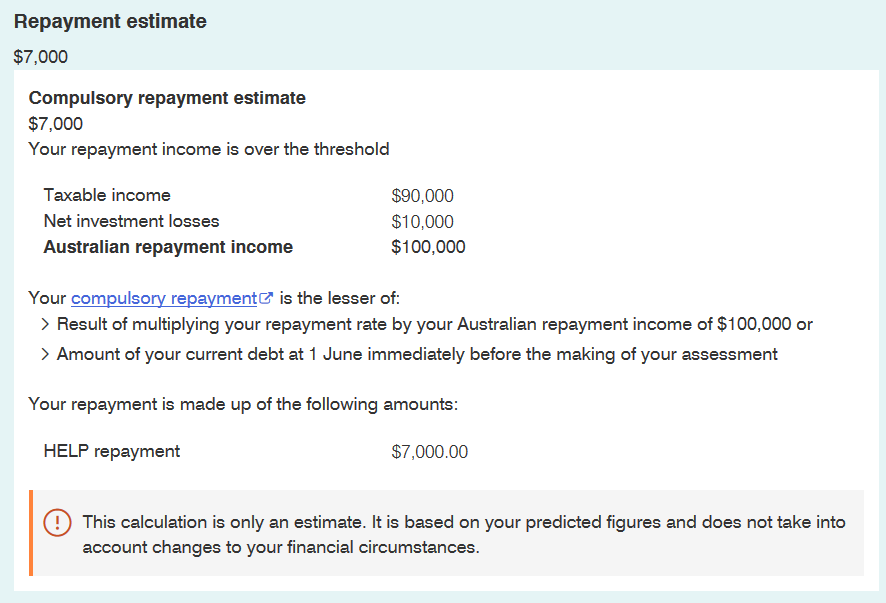

Expats With Student Loans Ato Data Matching Taxbanter

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

End Of Financial Year Guide 2021 Lexology

Tax Time 2021 Stationery Has Been Released Updated Taxbanter

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)